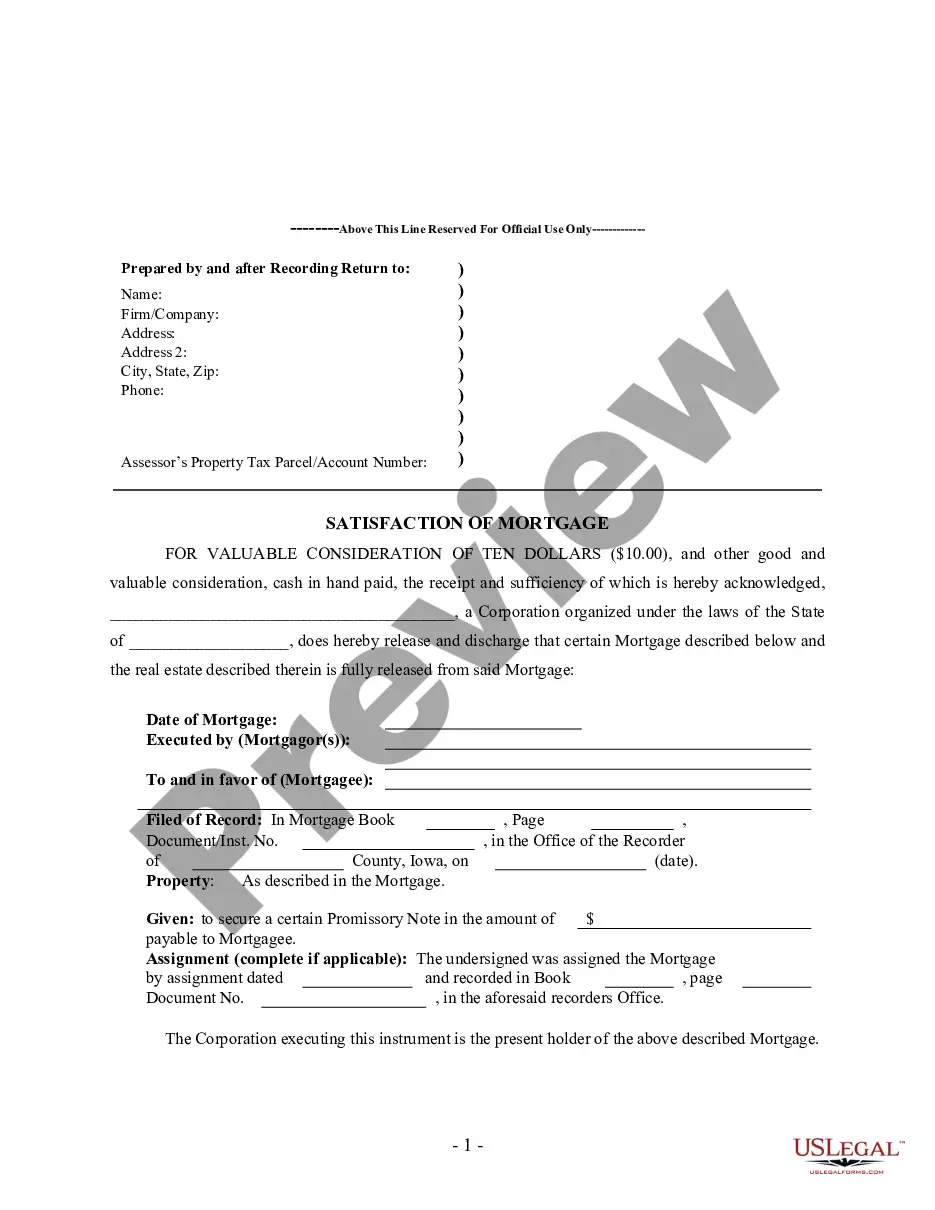

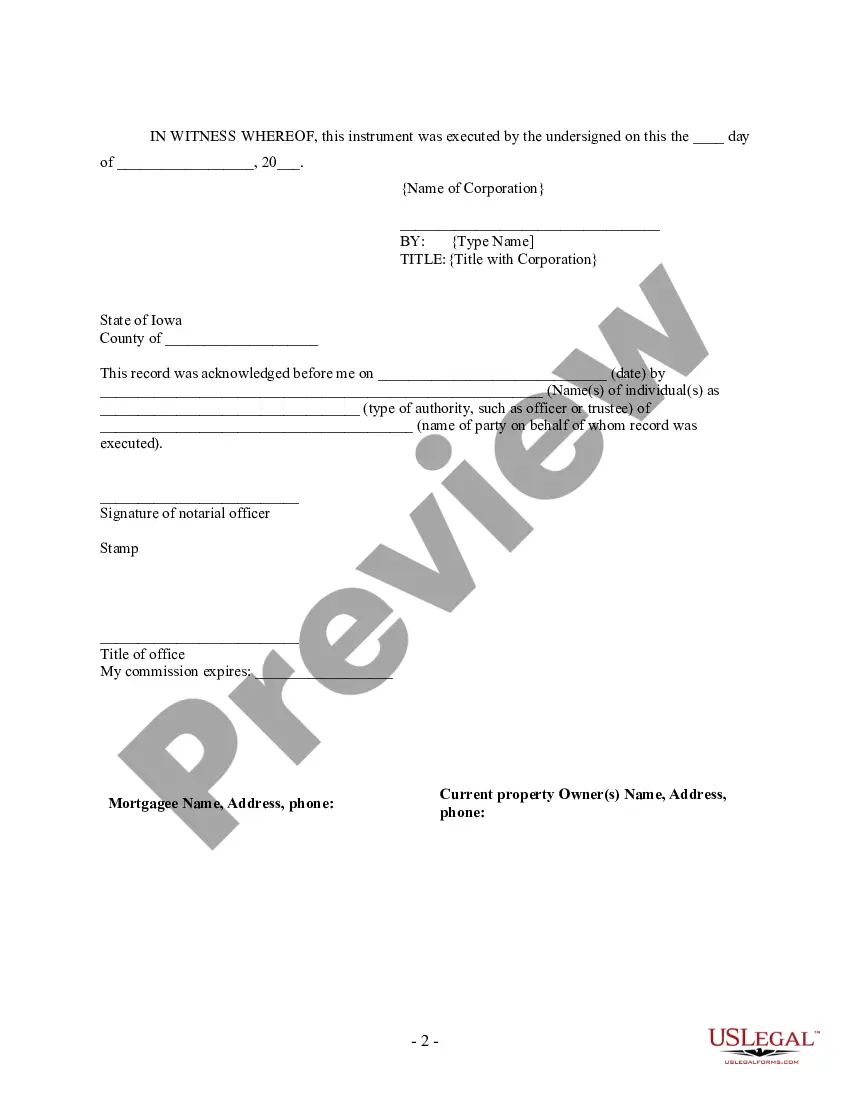

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Iowa by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Law summary Free preview Mortgage Lien Release Form

View Mechanic lien release form

View this form View Mechanics lien release form californiaView Mechanics lien release form california

View this form View Mechanics lien release form floridaView Mechanics lien release form florida

View this form View Mechanics lien release form nevadaView Mechanics lien release form nevada

View this form View Mechanics lien release form oklahomaView Mechanics lien release form oklahoma

View this formThere's no more need to spend time browsing for legal paperwork to meet your local state regulations. US Legal Forms has gathered all of them in one spot and streamlined their accessibility. Our platform provides more than 85k templates for any business and individual legal occasions collected by state and area of use All forms are appropriately drafted and checked for validity, so you can be confident in obtaining an up-to-date Blank Iowa Release Of Mortgage Form Form.

If you are familiar with our service and already have an account, you need to ensure your subscription is active before getting any templates. Log in to your account, choose the document, and click Download. You can also return to all saved paperwork any moment needed by opening the My Forms tab in your profile.

If you've never used our service before, the process will take some more steps to complete. Here's how new users can locate the Blank Iowa Release Of Mortgage Form Form in our catalog:

Preparing official paperwork under federal and state laws and regulations is quick and easy with our library. Try US Legal Forms today to keep your documentation in order!

Mortgage Release Letter Sample What Is A Lien Theory State Mortgage Satisfaction Letter Sample Release Of Mortgage Document Mortgage Release Form What Type Of Lien Is A Mortgage Satisfaction Of Mortgage Florida

What is a Satisfaction of Mortgage? A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.

What is a Satisfaction of Mortgage? A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage. This release of mortgage is recorded or filed and gives notice to the world that the lien is no more.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property.

Do not sign this form unless all applicable lines have been completed. IowaDocs® Form List.(Note: This list is just a reference of the forms available with the IowaDocs program. Essentials for UCC Filings. You MUST use National UCC Forms. If you are thinking about buying an online form, you should first understand whether Iowa law recognizes it. You can complete a Satisfaction of Mortgage document using the Rocket Lawyer document builder. Borrower shall promptly discharge any lien which has priority over this Security Instrument in the manner provided in. A: Yes, the lessee can complete and submit Form 411107. Chapter 17 forms a Respondent can use to file an Answer to the Petition:.

To change the state, select it from the list below and press Change state. Changing the state redirects you to another page.

Change state Close No results found. California Connecticut District of Columbia Massachusetts Mississippi New Hampshire New Jersey New Mexico North Carolina North Dakota Pennsylvania Rhode Island South Carolina South Dakota Washington West Virginia Law summary Satisfaction, Release or Cancellation of Mortgage by CorporationAssignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Assignment: It is recommended that an assignment be in writing and recorded immediately.

Demand to Satisfy: Upon full payoff, mortgagor may request recordation of satisfaction by mortgagee, who must comply within 30 days or face liablity.

Recording Satisfaction: When the amount due on a mortgage is paid off, the mortgagee must acknowledge satisfaction thereof by execution of an instrument in writing, referring to the mortgage, and duly acknowledged and recorded.

Marginal Satisfaction: Not allowed. Separate instrument required.

Penalty: If mortgagee fails to discharge a satisfied mortgage within thirty days after a request for discharge, the mortgagee is liable to the mortgagor and the mortgagor's heirs or assigns, for all actual damages caused by such failure, including reasonable attorney fees.

Acknowledgment: An assignment or satisfaction must contain a proper Iowa acknowledgment, or other acknowledgment approved by Statute.

655.1 Written instrument acknowledging satisfaction.

When the amount due on a mortgage is paid off, the mortgagee, the mortgagee's personal representative or assignee, or those legally acting for the mortgagee, and in case of payment of a school fund mortgage the county auditor, must acknowledge satisfaction thereof by execution of an instrument in writing, referring to the mortgage, and duly acknowledged and recorded.

655.3 Penalty for failure to discharge.

If a mortgagee, or a mortgagee's personal representative or assignee, upon full performance of the conditions of the mortgage, fails to discharge such mortgage within thirty days after a request for discharge, the mortgagee is liable to the mortgagor and the mortgagor's heirs or assigns, for all actual damages caused by such failure, including reasonable attorney fees. A claim for such damages may be asserted in an action for discharge of the mortgage. If the defendant is not a resident of this state, such action may be maintained upon the expiration of thirty days after the conditions of the mortgage have been performed, without such previous request or tender.

655.5 Instrument of satisfaction.

When the judgment is paid in full, the mortgagee shall file with the clerk a satisfaction of judgment which shall release the mortgage underlying the action. A mortgagee who fails to file a satisfaction within thirty days of receiving a written request shall be subject to reasonable damages and a penalty of one hundred dollars plus reasonable attorney fees incurred by the aggrieved party, to be recovered in an action for the satisfaction by the party aggrieved.