A contractual agreement that gives the right to service an already-existing mortgage.

Imran Husain, who recently graduated from the University of Toronto with a degree in Rotman Commerce specializing in Finance and a minor in Economics, is set to join Turner and Townsend in Infrastructure Consulting. His experience includes roles in real estate analysis at Hi-lo Investments, a stint at Brookfield Properties, and serving as a Financial Research Analyst at Wall Street Oasis. Imran's leaded as Vice President of the Rotman Commerce Real Estate Association, where he organized events and engaged with industry leaders. Alongside real estate development case competitions during his time at school.

Reviewed By: James Fazeli-Sinaki

Mortgage Servicing Rights (MSR) refers to a contractual agreement that gives the right to service an already-existing mortgage.

Usually, such an agreement is bought by the mortgage company, most commonly a major financial institution such as a bank or a third party that owns resources that allow it to service the mortgage.

Purchasing the rights to service a mortgage means that the servicer may need to handle the following tasks:

Hence, the responsibilities that the servicer is tasked with are routine loan management duties. For the servicer's work, the fee charged to the lender ranges from 0.25% to 0.5% of the mortgage balance.

The mortgage servicing rights (MSR) market has seen many changes. This section will highlight some of these developments and their implications.

In 2011, the Federal Reserve and the OCC took action against several major financial institutions by mandating improvements to servicing practices. The OCC, in particular, took steps to identify and address unsafe and unsound foreclosure practices.

This development meant that banks faced regulatory issues when handling their non-performing loans.

However, nonbank servicers were willing to handle these loans because of their cost and technological advantages. Therefore, banks increasingly outsourced the servicing of these assets.

Moreover, during this time, Fannie Mae introduced the “High Touch Servicing Program,” which made it simpler to facilitate the transfer of non-performing assets from banks to servicing companies.

In 2013, the Internal Revenue Service (IRS) issued a Private Letter Ruling (PRL) that incentivized REITs to invest cash flows into MRS instruments.

The PRL made it possible for some instruments to qualify as assets for REITs to hold and invest in, encouraging them to invest in MSR.

In January 2014, new servicing standards were set by the Consumer Financial Protection Bureau (CFPB). These requirements applied to banking institutions and special servicers with assets over $10 billion. The standards are meant to protect consumers.

Today, the mortgage servicing market (MSR) and its corresponding financial instruments continue to gain popularity. As interest rates are rising in today's economy , we find that the MSR market stands to achieve for the foreseeable future.

Several reasons exist for determining the performance of MSR instruments. Today, the market for these instruments is strong because of much safer loan originations after 2008, reducing the risk of defaults.

Historically, the value for such instruments has risen as interest rates increase and, conversely, has fallen when interest rates decrease.

This directly proportional relationship holds because the likelihood of a borrower paying off the mortgage faster, i.e., making prepayments, falls as interest rates rise.

This phenomenon was observed recently as rising interest pains continue to devastate the industry; the MSR market stands out as it thrives in this environment, as reported in this article.

This relationship means that the servicing company will receive mortgage fees for a longer time as interest rates rise and prepayments fall.

Moreover, about interest rates, as interest rates rise, borrowing costs rise, and thus, individuals and firms have an incentive against borrowing capital.

Therefore, to some extent, in such an environment, the servicing firm will have a lower pool of public debt that can be serviced.

This means servicing firms can face downward pressure on the commission due to an increasingly competitive environment.

Housing market fluctuations can directly impact the stability of the servicing industry. For instance, consider the scenario of the 2008 financial crisis , where real estate saw a sharp downturn with innumerable defaults on payments.

In such an environment, servicing firms face pressure, as the debt they are servicing faces a much higher default risk. Ultimately, this causes the firm's stability and the industry to decrease.

Moreover, the clients of servicing firms, usually big banks, face a financial crunch in this challenging environment. Thus, the servicing firm must navigate many challenges in such a hypothetical scenario.

When the housing market is strong, the public mortgage debt outstanding increases, as individuals and firms need more capital to purchase real estate. Therefore, servicing firms may capitalize in such an environment by raising commissions due to an optimistic atmosphere.

Although the risks mentioned above exist for the MSR market, mortgages and MSRs are still popular among Real Estate Investment Trusts (REITs), hedge funds, banks, and retail instruments because of the stable cash flow yields.

Lenders incur costs when mortgage servicing rights are outsourced, as the servicing firm requires a fee for providing such services. Therefore, lenders need to analyze whether the commission charged by a servicing firm is worth it.

Several factors cause lenders to outsource such services. This may include:

Perhaps the most crucial reason lenders have a solid incentive to outsource servicing duties that the lender can focus its resources on its core business, including issuing new mortgages and working with borrowers.

Moreover, the lending firm can cut costs on servicing duties and focus capital on the core business of the lending firm, which, again, is initiating and approving mortgages for credit-worthy individuals.

Due to the reasons above, the lending industry has increasingly shifted to outsourcing servicing to third-party firms.

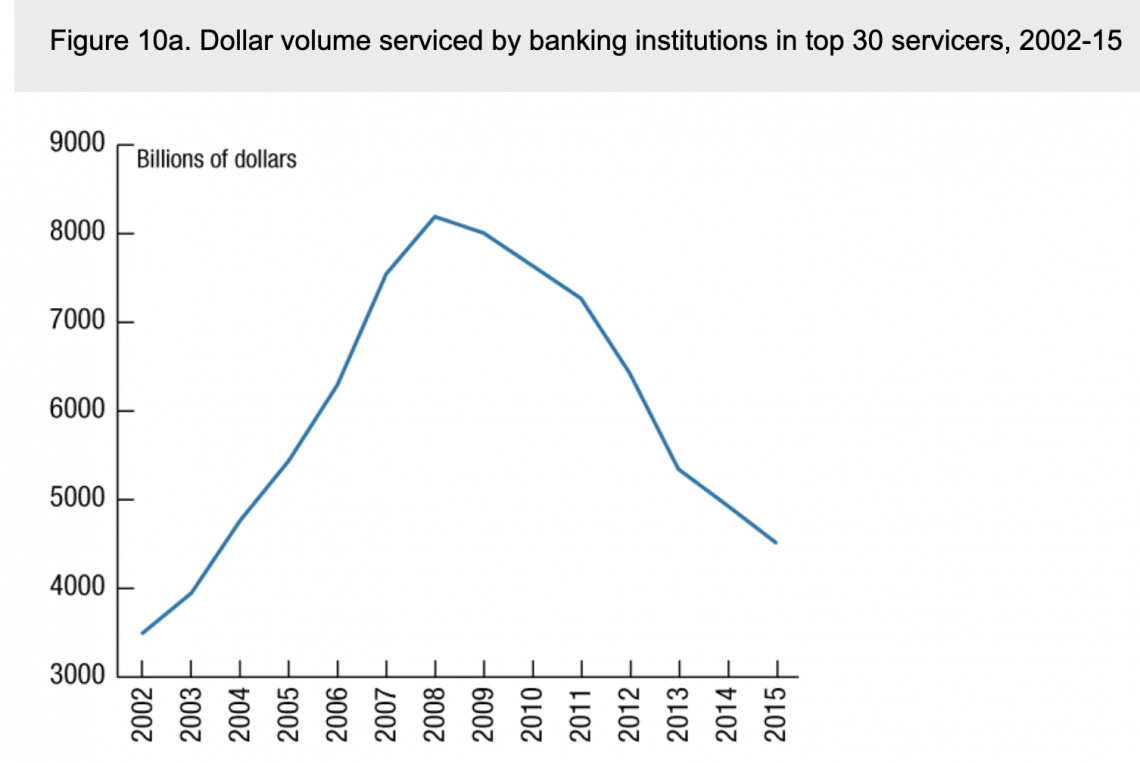

This is evident from the chart below, which shows a sharp fall in the pool of debt serviced by banking institutions. This implies that the debt is serviced by servicing firms and some non-bank lending firms.

Lenders do not legally need to ask for permission from the borrower to transfer servicing rights. Even so, the lender needs to step in when a complicated situation arises, such as when a borrower cannot make payments and is not complying with the agreement.

Therefore, lenders find it profitable to pass mortgage servicing rights to a third party, usually saving costs, and experience the added benefit of not worrying about servicing the debt.

For the mortgage borrower, nothing about their loans changes except that a third party handles the administrative duties and loan management. So as far as the borrower is concerned, they are dealing with a different party when inquiring about their loan.

This means that the loan amount, interest rate , monthly payment, total payable amount, and other factors are the same as before.

Thus, it is imperative to understand that lenders recognize that borrowers do not usually have much preference when dealing with a third party or their lender when making payments.

Federal banking laws today allow lenders to sell mortgage servicing rights or transfer them to another party without the borrower's consent. However, in case of a transfer or sale, the borrower shall be notified fifteen days before the changes.

Borrowers may sometimes encounter issues with the third party servicing their mortgage. In such an instance, a complaint should be filed with the Consumer Finance Protection Bureau.

If you have a student loan, you can make a query to the Federal Student Aid Office of the Department of Education. A suspected fraud case can be reported to the Federal Trade Commission (FTC).

Consider the following example of a lender firm selling its mortgage servicing rights to a third-party firm specializing in such operations.

Here are some pieces of information associated with this example:

Given the above information, the lending firm, usually a bank, can outsource its duties to a third-party firm for a fee.

As discussed before, sometimes, it may make economic sense for the lending firm to hire a specialized firm to complete such tasks, as they can achieve it at a lower cost per unit.

For the borrowers that owe the $20 million, nothing has changed except for the address to which payments are routed and the party dealing with difficulties.

Such an example illustrates the benefit that both servicing firms and lenders stand to gain in such a deal. Further, usually, borrowers barely experience any difference through such a process.

Several firms specialize in providing services that manage mortgages. Some examples include:

As mentioned before, the firms above manage mortgages for mortgage lenders. In exchange for servicing the mortgages, they receive a commission without even owning mortgages.

Usually, mortgage servicing firms are backed by government agencies/enterprises such as Ginnie Mae, Fannie Mae, and Freddie Mac .